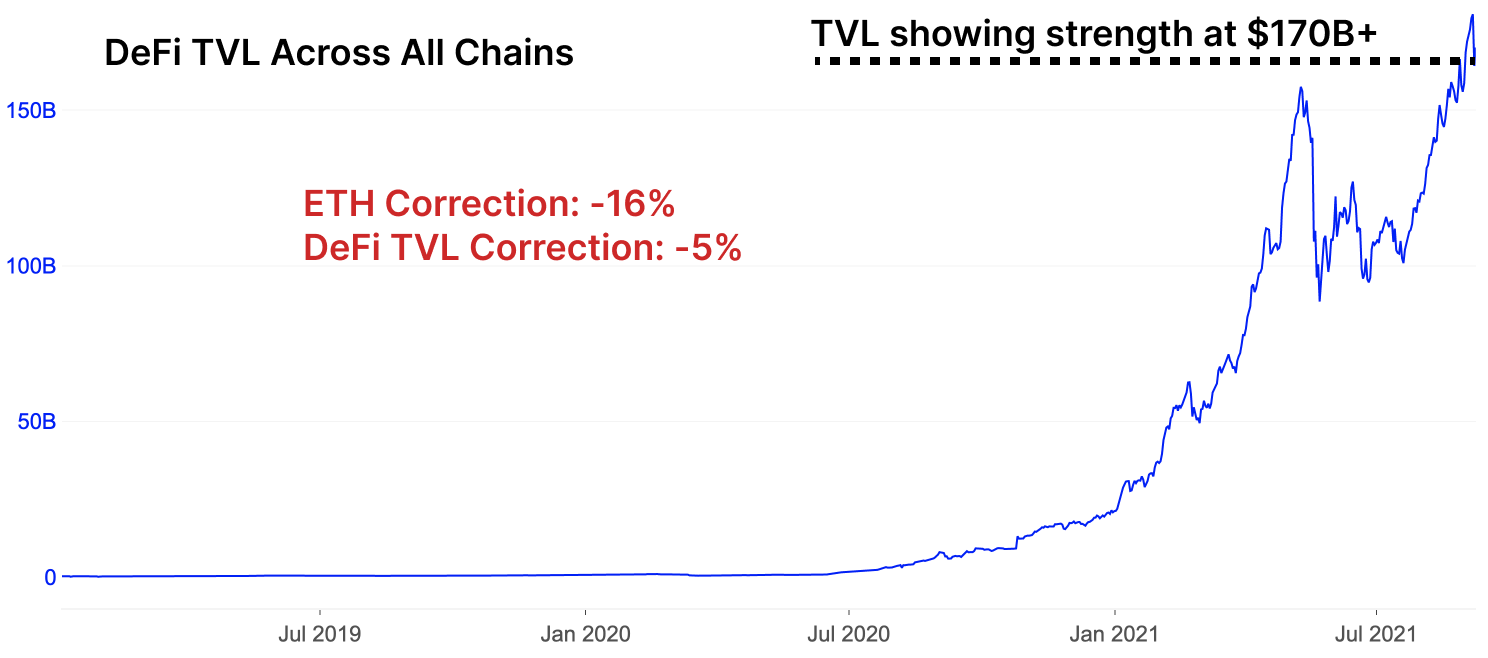

Despite the fact that almost all cryptocurrencies this week faced a sharp drop in prices, more and more capital is flowing into the DeFi protocols.

This positive trend for the DeFi industry was reported by analysts from glassnode, which monitored the indicator "Total Value Locked" in the DeFi market compared to the value of tokens or coins.

As shown in the graph above, the DeFi protocols absorbed more and more capital despite the corrections, losing only -5% of the maximum TVL measured value during the sale. In the case of the cryptocurrency ETH it was up to -16% and in some tokens even more.

It should also be noted that DeFi TVL showed high resilience at the level of $170B, which means that the DeFi market even exceeded the ATH, which was measured in May this year. Ethereum as well as other tokens are still below the May ATH.

After a thorough analysis of why TVL is growing and is also more resilient than the value of tokens or coins is a really interesting observation. At present, the value of the DeFi market is being positively affected by stablecoin-centric protocols, which continue to grow and show ever-increasing interest despite corrections. Governance tokens as well as the NFT and Ethereum, on the other hand, weakened.