- Hedget is a decentralized protocol for trading options and this is its review.

Hedget ended its token sale just a month ago, let’s take a closer look at it.

Hedget is sure that future economies will be built on cryptocurrencies and thus offers you decentralized opportunities to secure the safest position in the market, which is protected against unexpected price movements, i.e. volatility.

As mentioned in the introduction, Hedget is here to fight high volatility in crypto markets and thus comes as a decentralized platform for options trading.

How does Hedget want to achieve this?

Hedget simply wants to eliminate the risks associated with a significant drop in prices in a similar way as in traditional financing, i.e. by using options and other derivative products.

The company believes that a similar infrastructure for DeFi protocols should exist here to protect traders’ positions from fluctuations.

On this decentralized platform, users can buy and sell option products by providing collateral in the form of cryptocurrencies, including stablecoins. This way, users can hedge their risk for their crypto portfolio and also for their debt positions in other lending protocols, such as Compound3 and Aave.

Options are also considered a special type of derivative product because the price of options are derived from both the price and fluctuation of the underlying assets.

The option products offer decentralized price hedging against their current crypto holdings.

Explanation:

- As ETH price fluctuates, buying a protective put option allows users to be able to sell at a certain price.

- Compared to selling ETH for stablecoins, buying a put option gives holders the right to protect against downward price movement but also enjoy ETH appreciation because they could choose not to exercise the option.

How it works?

Architecture

Hedget consists of three main components:

- ESC: Ethereum smart contract which handles ETH and ERC-20 token deposits and withdraws and implements physical settlement.

- CTD: Chromia-based blockchain (dApp) which handles trades, track ownership of contracts and facilitates communication necessary to perform settlement through Ethereum smart contracts.

- CSW: Client-side wallet and trading user interface, which takes commands from user and carries them out using Ethereum smart contract and Chromia dApp.

Hedget Token (HGET)

The HGET token is a native utility and governance token of the Hedget platform.

The strategy for increasing interest and token circulation is to set it the way that if you want to create and trade option products, you must deposit at least a small number of HGET tokens.

As for the token network, it runs on the Ethereum network as an ERC-20 contract and is represented on the Chromia sidechain.

The role is clear HGET serves as a management token for the entire platform.

If you are a token holder, you can also take a part in various votes on adding new assets, default options parameters and also UI improvements.

Token Distribution

The hedget protocol has a fixed supply of tokens and totally of 10M (HGET) tokens will be minted when the network is started.

- 10% of the tokens will be reserved for team and advisors

- 9.77% of the tokens will be distributed through private sale via SAFT

- 4.23% of the tokens will be distributed to users and investors through public sale

- 50% of the tokens will be locked for liquidity mining, tokens will be minted on a daily basis and distributed to users who participate in writing options (0.02% of underlying of each option settled and additional for native Hedget MM)

- 7% of the tokens will be used for DEXes liquidity and trading (such as Uniswap), trading competitions, drops and other activities to kickstart the usage of Hedget protocol

- 19% of the tokens will be locked in reserve fund until 2 years after the platform is live and the usage of these tokens will be determined by Hedget DAO.

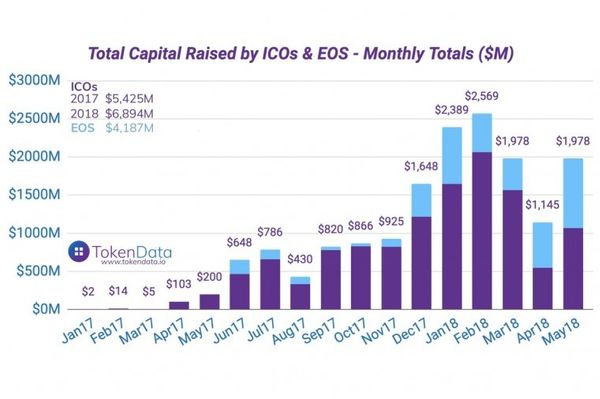

The token sale ended on September 12, 2020, the token price was 1 HGET = $ 13 and a total of $ 7,370,000 (100%) was sold, informs ICO drops.

Roadmap

Hedget Launch, as you can see on the roadmap, is scheduled for 2021 Q1, but before that it will have a BETA testnet, which focuses, among other things, on Chromia L2 for trading exercise and settle options real collateral and settlements on mainnets.

Conclusion

Although it is still too early to evaluate the functionality of this decentralized platform, I like the plans and activity of the team.

I would therefore summarize it as follows:

Hedget protocol is a very sympathetic project that wants to fight windmills (volatility), which is still high in the crypto markets but I support them all the more and i admire it, because it will not be easy and I see that they really care about protecting users against these persistent risks.

![Technology VPE bank opens Bitcoin [BTC] and crypto exchange for whales](/content/images/size/w600/2018/04/19f3fc341339c0f92d1d371b4c1c8c6b_1525098027-b.jpg)