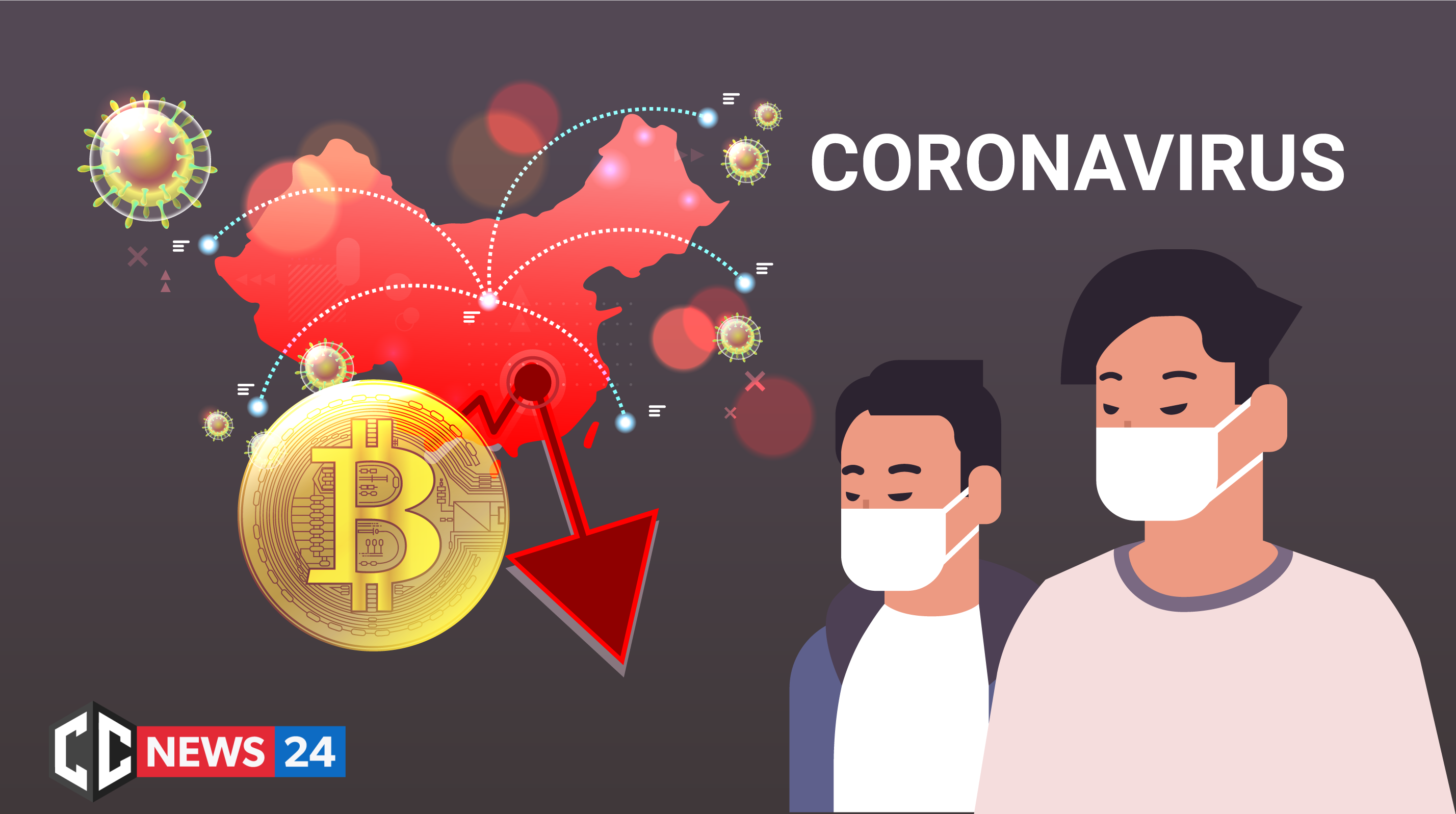

As we all know, last week was very dramatic as a result of widespread coronavirus and panic.

In the classic grocery stores people making large purchases as a stocking up, but on the other side trading markets like stocks/cryptocurrencies markets experienced a deep downturn.

Unless the panic around the coronavirus has stabilizes and dont calm down, we do not expect a high inflow of finance into the tradingmarkets, but let’s look at the technical analysis together.

- 1H we can see a 1/2/3/4/5 structure and a completing ABC pattern are formed which could first shoot the BTC to 9 200$ / 9 300$ and then test the 8 000$ threshold.

- 4H we see a likely reversal of the trend.

- RSI shifted from oversold zone.

- MACD lines support further upward movement.

- The RSI and MACD prizes create a bullish divergence.

- Over the weekend we could see the accumulation and the creation of a bullish wedge pattern.

- We see the 3 lows structure with declining power of bears.

- The accumulation lasted 4 days, which is a long enough time for the bull’s impulse to come.

- A 9 000$ test is possible, but we have to be careful, because we register resistance at 9 100$

Be very careful and trade responsibly towards your own finances in these times.

704 Views